Aristaco Herrera

Mortgage Broker

NMLS #2454739

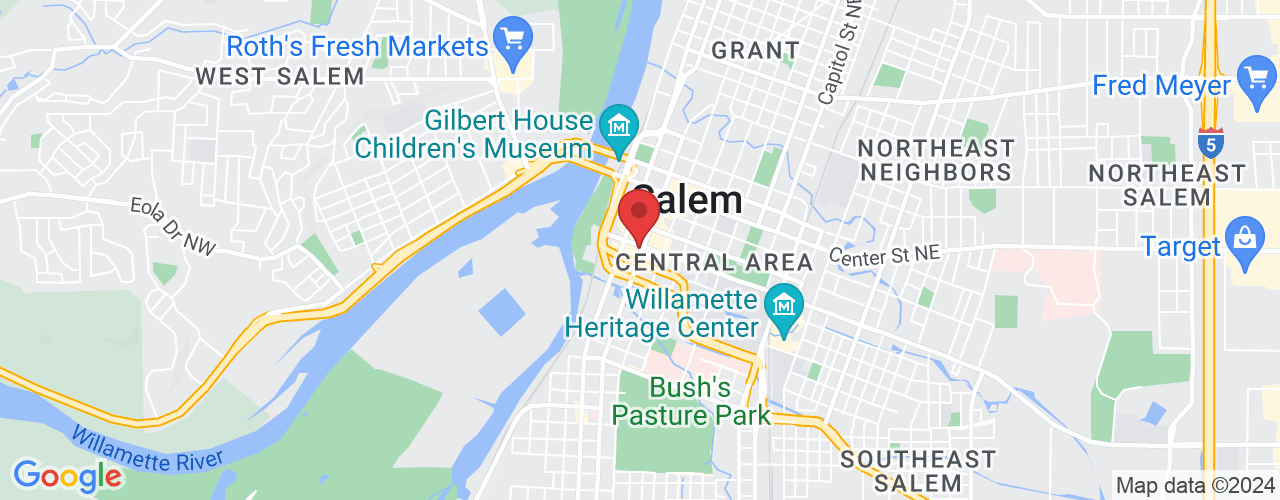

ADDRESS

388 State St Suite 975

Salem, OR 97301

CONTACT

(503) 990-7486

(503) 501-9715

(971) 353-5593

Simple solutions, it just makes sense!

Whether you're buying, selling, refinancing, or building your dream home, you have a lot riding on your loan specialist. Since market conditions and mortgage programs change frequently, you need to make sure you're dealing with a top professional who is able to give you quick and accurate financial advice. As an experienced loan officer I have the knowledge and expertise you need to explore the many financing options available. Ensuring that you make the right choice for you and your family is my ultimate goal. And I am committed to providing my customers with mortgage services that exceed their expectations. I hope you'll browse my website, check out the different loan programs I have available, use my decision-making tools and calculators, and use our secure online application to get started. After you've applied, I'll call you to discuss the details of your loan, or you may choose to set up an appointment with me using my online form. As always, you may contact me anytime by phone, fax or email for personalized service and expert advice. I look forward to working with you.

Our Satisfied Clients

Affordability Calculator*

This calculator will help you to determine how much house you can afford and/or qualify for.

Contact Us Today

Want a quick quote? Please fill out this form!

Latest Blog Posts

Current Mortgage Rates and Trends for Summer 2024

Introduction:

As we enter the summer of 2024, prospective homebuyers and current homeowners are keeping a close eye on mortgage rates. Understanding the current trends and forecasts can help you make informed decisions about purchasing or refinancing your home.

Current Mortgage Rates As of June 2024, the average rate for a 30-year fixed mortgage has decreased to 6.87%, down from the previous week's 6.95%. Similarly, the average rate for a 15-year fixed mortgage has also seen a decline, currently standing at 6.13% (Money) (The Mortgage Reports). This downward trend provides a favorable environment for both new homebuyers and those looking to refinance their existing mortgages.

Factors Influencing Mortgage Rates Several factors are contributing to the current mortgage rate trends:

Inflation: With inflation rates slowly stabilizing, the pressure on mortgage rates has eased somewhat. The current inflation rate is 3.4%, which is slightly lower than the previous month (Moneywise).

Federal Reserve Policies: The Federal Reserve has indicated a "higher-for-longer" stance on interest rates, which has kept mortgage rates within a narrow band. However, there are expectations for potential rate cuts later in the year if inflation shows sustained progress towards the Fed's targets (The Mortgage Reports).

Economic Indicators: The broader economic environment, including employment rates and GDP growth, continues to influence mortgage rates. Recent economic data suggests a cooling economy, which may help to keep mortgage rates steady or even lower in the coming months (Moneywise).

What This Means for Homebuyers and Homeowners For those looking to buy a home, the current rates provide a relatively favorable borrowing environment. It's important to shop around and compare rates from multiple lenders to ensure you get the best deal. For existing homeowners, refinancing at the current rates could result in significant savings, especially if your current mortgage rate is higher than the prevailing rates (Money).

Conclusion Staying informed about mortgage rate trends is crucial for making the best financial decisions. Whether you're in the market for a new home or considering refinancing your current mortgage, understanding the factors that influence these rates can help you navigate the complexities of the mortgage landscape.

About Us

We strive to deliver the highest levels of service to help you reach your goals. We thank you for your trust and support. From the first call to closing, our team is with you every step of the way!

Loan Options

Fixed Rate Mortgage

Jumbo Home Loan

First Time Home Buyer

Investment Property Loans